KOTAK MAHINDRA BANK – A FAMOUS BANK IN INFAMOUS ACTIVITIES CLAIMED BY A GROUP OF AGGRIEVED CUSTOMERS

A Delhi Sessions Court has directed SHO of Barakhamba Road Police Station, New Delhi to register FIR and investigate the matter against seven accused i.e. Kotak Mahindra Bank Ltd along with Uday S. Kotak, (Managing Director & CEO), C. Jayaram (Joint Managing Director), Dipak Gupta (Joint Managing Director), Sanjay Kumar (Officer), Managers of Kotak Mahindra Bank K.G. Marg & Pitampura branches and another Virendra Kumar Sharma on the basis of complained filed by Mumbai based businessman Dr. Santosh Bagla and his Family. Earlier Reserve Bank of India (RBI) had asked Kotak Mahindra Bank to examine and redress the grievances of the complainant within a time-bound manner. Dr Bagla had earlier complained to the Prime Minister’s Office (PMO) about vindictive action by the Bank which was passed on with instructions to examine the matter.

The complainants Dr. Santosh Kumar Bagla, his wife Smt. Pushpa Bagla and son Bhupendra Bagla have filed complaint of frauds, forgery and illegalities against Kotak Mahindra Bank and its Directors and officials with police and to various higher authorities. The complaint of Mr. Bhupendra Bagla against Kotak Mahindra Bank, Mr. Uday S. Kotak and others was filed U/s 420/464/465/467/ 471/120B/34/109 of IPC.

The concerned Metropolitan Magistrate, New Delhi has now directed the Police Station, Barakhamba Road to register the case, an FIR No. 0120/2019 dated 19.10.2019 at PS Barakhamba Road New Delhi is registered against Kotak Mahindra Bank Ltd and six other accused including Mr. Uday S. Kotak, MD & CEO.

The aggrieved person are a Business family established in Mumbai who were holding directorship in various companies and once having capitalization of more than Rs. 100 crores. The conspiracy was hatched by the officials of Kotak Mahindra Bank, i.e. Mr. Uday Suresh Kotak, Mg. Director & CEO, Mr. Sanjay Kumar, Officer, Chandra Shekhar Prasad, the then Dy. Manager (Legal), Ms. Bina Chandarana, Company Secretary, Branch Head of D-10, No. 1 & 2, Block D, Local Shopping Centre, Vasant Vihar, New Delhi, The then Regional Manager (Delhi Region), in collusion with one Mr. Virendra Kumar Sharma, the owner of a property situated at Okhla Industrial Area, Phase-II, New Delhi.

The Property No. E-41/4, Okhla Industrial Area, Phase-II, New Delhi was taken on lease on 26.12.2006 by one Cogent EMR Solutions Ltd for a monthly rent of Rs. 4.50 lacs for a period of 14 years. The officials of Kotak Mahindra Bank approached to a company Cogent Ventures (India) Ltd which is a sister concern of Cogent EMR Solutions Ltd. and was also having its office in the said Premises, offering them an unsecured loan of Rs. 50 lakhs on the basis of net worth of the Company. The Company Cogent Ventures (India) Ltd has been a listed company having its net worth approx Rs. 50 crores. The said unsecured loan of Rs. 50 lakh was a meager sum in comparison to the net worth of the said company.

The officials of Kotak Mahindra Bank themselves had an evil eye on the said Property and wanted to get the same for Kotak Mahindra Bank’s own office use. For this purpose they had a talk with Mr. Uday Suresh Kotak, the MD & CEO. For achieving their ill design and to grab the well furnished property at a lower rental cost, these person, made a plan to throw out the company Cogent EMR Solution Ltd from the said premises and allured and trapped the said company by offering and sanctioning some business loan as unsecured loan.

Lured by Kotak Mahindra bank’s offer, the owner informed the Bank about the tenant Cogent EMR Solutions Ltd. and the remaining period of tenancy. The Bank in connivance with the above named person, hatched a conspiracy to dispossess the tenant company from the said Premises.

In furtherance of the said common intention and conspiracy, Kotak Mahindra Bank granted credit facilities to the said Company on the basis of its net worth and an unsecured loan of Rs. 50 Lacs to the said Cogent Ventures (India) Ltd for their business expansion. It is pertinent to mention that Bhupendra Bagla, son of the complainant, was not involved, at the time of execution of lease deed. He was not involved in the day to day affairs of the company during his directorship.

Subsequently, in furtherance of said illegal common intention and conspiracy, the Bank started to create pressure for early repayment of loan and for illegally evicting the said Cogent Ventures (India) Ltd from the said Property. The officials of the Bank in collusion and in connivance with each other, hatched a conspiracy and forged and fabricated documents including one affidavit and another power of attorney which were alleged to have been executed by Bhupendra Bagla, for mortgaging the said leased Property against the said unsecured loan and on the basis of said forged and fabricated documents, the Bank initiated recovery proceedings before the Ld Debt Recovery Tribunal by filing an Original Application being O.A. No.57 of 2009.

In the said OA, the bank did not file the original documents concerning the said property and made submissions before the DRT that the original documents were returned to the original documents to the borrower. It is evident that as the said documents were not signed by Bhupendra Bagla and were forged and signed by the above named person of the Bank, Bank deliberately and with malafide had destroyed the originals and did not produce the same before the courts; otherwise the Bank would have been implicated in the FIR. It is stated that as the alleged loan was unsecured one, there was no question of execution of any documents qua mortgage of any property. It is therefore evident that the documents were created and forged in collusion and conspiracy so that the pressure can be built upon the possessor of the premises and it be evicted much before the lapse of the lease period and is given to the Bank.

The above named officials of the Bank in order to implicate Bhupendra Bagla and to create pressure for the recovery of loan amount, filed a complaint dated 17.09.2009 for cheating, criminal breach of trust, dishonest misappropriation of property, criminal conspiracy and forgery, however the police did not registered the said complaint. Thereafter, the officials of bank conspired together and a complaint was lodged by the complainant /owner before the PS Barakhamba Road despite the fact that the property is situated at Okhla and address of Bhupendra Bagla was given of Chattarpur/ Green Park; even the address of the owner was given of Maharani Bagh, South East Delhi. There was no locus of the PS Barakhamba to register the said complaint as none of the parties resides or working for gain in the jurisdiction of Barakhamba Police Station nor the said property was under its jurisdiction as the loan was processed, sanctioned and disbursed at Vasant Vihar Branch of the Bank. It is evident, therefore, that the Bank had acted in collusion and connivance with its officials and also had managed certain police officials at PS Barakhamba.

The Cogent Ventures (India) Ltd. filed its counter objections in the said OA before the DRT and denied the execution of the said documents by said Bhupendra Bagla. However, later on the Company Cogent Ventures (India) Ltd., paid off the entire liability of Rs.50 Lacs along with interest total amounting to Rs.59,14,250/- to Kotak Mahindra Bank.

The Kotak Mahindra Bank on 11.11.2009 in support of Virendra Kumar Sharma wrote to SHO, PS Barakhamba that bank has also intimated the police regarding the alleged fraud. However, the Kotak Mahindra Bank on the very next day i.e. 12.11.2009 wrote to Cogent Ventures (India) Ltd clarifying that the said Loan was without any collateral security or mortgage and it was further clarified that the said leased Property was not mortgaged or hypothecated with the Bank. It was also averred that the Cogent EMR Solutions Ltd was the lessee and not the owner of said leased Premises. Subsequently, an application U/o 23 Rule 3 CPC, was jointly filed by Cogent Ventures (India) Ltd. and Kotak Mahindra Bank before the DRT on 13.04.2010 for withdrawal of said O.A., stating therein the same facts as mentioned in the said letter dated 12.11.2009.

FALSE & FRIVOLOUS FIR AGAINST BHUPENDRA BAGLA AND HIS ILLEGAL DETENTION

The said officials of the Bank in collusion with each other, despite the settlements with Cogent Ventures (India) Limited, in conspiracy with each other, had given the above said forged documents on the basis of which the owner filed a complaint against the Bhupendra Bagla with PS Barakhamba Road, where an FIR No. 149/2009 was registered, despite the fact that PS Barakhamba Road had no jurisdiction to investigate the matter as the property in question was situated in Okhla, South East Delhi.

The said Bhupendra Bagla in the above said FIR was got arrested illegally despite the fact that he had bail orders from the court of Mumbai where he was residing at the relevant time. The IO of the case was managed by Kotak Mahindra Bank as he refused to take his statement he was called on by the IO to appear on 27.04.2010, Dr. Santosh Kumar Bagla (his father) accompanied him to the police station and met the SHO Sh. Amandeep in this regard and SHO called the IO and told to record the statement of Bhupendra Bagla and at that time IO called the DCP i.e. Mr. Shanker Dass who instructed the IO to arrest Bhupendra Bagla. When Bhupendra Bagla & Dr. Santosh Kumar Bagla visited the IO for giving his statement, the IO arrested Bhupendra Bagla illegally and malafide.

COMPLAINT OF AGGRIEVED BUT NO ACTION

In between the CVIL Infra Limited (earlier known as Cogent Ventures (India) Ltd) also lodged a complaint dated 22.04.2010 with the SHO, PS Barakhamba Road, New Delhi stating all the true facts, but no action was taken by the then SHO. Consequently, a complaint dated 26.04.2010 was also sent to the Additional Commissioner of Police but the said complaint also put in deaf ears. Thereafter, Bhupendra Bagla filed a complaint U/s 156(3) Cr.P.C. before the competent court. The concerned Metropolitan Magistrate, New Delhi has now directed the Police Station, Barakhamba Road to register the case and an FIR No. 0120/2019 dated 19.10.2019 at PS Barakhamba Road New Delhi is registered against Kotak Mahindra Bank Ltd and six other accused including Mr. Uday S. Kotak, MD & CEO.

Earlier, the charge sheet was filed on 24.07.2012 on the basis of the photocopy of the alleged documents and even the CFL was conducted of the said photocopy. The Court of Sh. Dharmendra Singh, Ld. Metropolitan Magistrate, PHC, New Delhi ultimately vide order dated 10.12.2018 discharged Bhupendra Bagla from all the charges as prosecution failed to establish even a prima facie case against him and held that the loan was not given to Bhupendra Bagla.

It is stated that the IO failed to appear on several occasions before the court and thereby delayed the proceedings for such a long period. The matter was prolonged for more than 6 years after the charge sheet and the aggrieved named above have to face the torture, mental agony and harassment for about nine years since the registration of false and frivolous FIR.

The officials of Kotak Mahindra Bank are very well aware that charge qua any property in case of the company, is created or effected only by filing Form No. 8 & 13 with the Registrar of Companies (RoC) which should be duly signed by both the Bank and borrower; Bank is required to take original title documents with chain of title to create equitable mortgage of the property but in the present case neither any such document were taken by the Bank nor any document were filed with the RoC as is clearly evident from online record of the concerned RoC. It is noteworthy that every banker, is aware that mere power of attorney and affidavit are not sufficient for creation of charge/ mortgage of an immoveable property in any case as several guidelines have been issued by the RBI in this regard and it is the regular practice of every banker as how to give loan and create mortgage but in this case, the above named officials of the Bank in collusion with the owner of the said Property, deliberately just to quench Bank’s conspired thirst, committed offence as well libel (defamation) against the aggrieved person as well as had launched a malicious prosecution against them.

LOST TO THE REPUTATION AND WEALTH OF THE AGGRIEVED

In the aforesaid manner, Kotak Mahindra Bank has not only maligned the social and business reputation of the aggrieved but have also caused wrongful loss to the person and property of Bhupendra Bagla so much so that he had to resign and sell his stake of various companies and also his property at rock bottom prices. Bhupendra Bagla was even constrained to resign ante dated from various companies. He was further pressurized to sell his shareholdings of various companies at throw away price and thereby he suffered a great financial loss and reputation.

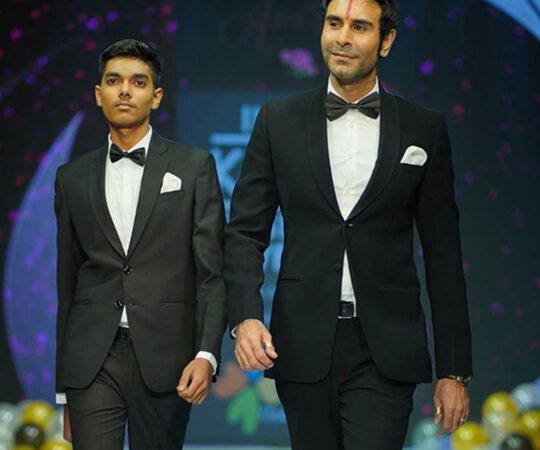

The said Bhupendra Bagla is a respectable citizen of this country and had been enjoying very good reputation, command and great respect amongst the family, friends, colleagues and locality as well as community. He was having sufficient means and was directors in several companies; he was also shareholders of several companies. The said Bhupendra Bagla was having great respect, dignity and prestige in Society and was having blot-less career throughout his life. However, due to the illegal acts of the above named officials of Kotak Mahindra Bank & said Virendra Kumar Sharma, he suffered a lot and could not progress for the last more than 10 years rather he has to spent approx. Rs. 2.5 Cr. for the litigation and lodging and boarding to defend the false prosecution initiated by the Bank and its officials. Besides this, the marriage of Bhupendra Bagla has also resulted in his Divorce in the year 2013. His family and family life has been shattered. He had to resign from the directorship of various companies and all his invested funds in various companies got blocked due to such false accusations and arrest, caused by the Bank and its officials. The said Bhupendra Bagla faced great difficulty and incurred huge expenses while defending the false and concocted case/FIR.

FALSE AND FRIVOLOUS NEWS REPORT PUBLISHED IN MEDIA

The aggrieved have also suffered due to the officials of Kotak Mahindra Bank and the complainant’s illegal prosecution /act. The concerned officials of the bank in connivance with the complainant/ owner with malafide have also got published the false & frivolous news report in respect of involvement of the aggrieved persons’ family, in the daily newspaper “Navbharat Times” dated 30.04.2010 with title KIRAYE KI BUILDING PER 50 LAKH LOAN !. The contents of the above said false new reports were highly defamatory.

It is stated that for the harassment on the part of Kotak Mahindra Bank, its officials and another and protracted litigation further resulted Dr. Bagla’s felling sick and going into acute depression. Dr. Bagla being apprehensive of danger to his life and liberty, therefore, has even sought for providing security to him and his family and in this regard he has written to Ministry of Home Affairs / Delhi Police.

The Kotak Mahindra Bank is expert in managing the police officials as well as it is well equipped with the anti social elements which Kotak Mahindra Bank uses for recovery of loans, credit card dues, NPA recovery etc. However, despite the above stated illegalities done by Mr. Uday Suresh Kotak, he managed to be appointed as the chairman of IL&FS.

Due to the said averments which the officials of Kotak Mahindra Bank and the complainant / Virendra Kumar Sharma made in multiple litigations and publication, which are now a public documents, the reputation of the aggrieved has been tarnished in the eyes of their friends, employees, business relations etc., which cannot be repaired. The credibility built by the aggrieved during span of time has been shattered due to writing the false, frivolous, fictitious and baseless allegations against them.

The above facts also suggests that the illegalities are being done by the above named person on behalf of the Bank in routine manner with other persons also. Hence, it is necessary to investigate the present matter at high level thoroughly and properly, for the interest of general public at large as well.